Featured

Bank Secrecy Act Ctr Requirements

The concept of money laundering is very important to be understood for those working in the monetary sector. It's a process by which dirty cash is converted into clean cash. The sources of the money in precise are prison and the cash is invested in a means that makes it appear to be clear money and conceal the id of the criminal part of the money earned.

While executing the monetary transactions and establishing relationship with the new prospects or maintaining existing customers the responsibility of adopting sufficient measures lie on each one who is a part of the organization. The identification of such factor at first is simple to deal with as an alternative realizing and encountering such situations later on in the transaction stage. The central bank in any nation supplies full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present enough safety to the banks to discourage such situations.

This topic will educate the learner on the recent progress of money laundering detection and prevention the purpose of the Bank Secrecy Act BSA and information regarding the penalties for violating the BSA. For financial institutions wanting to report suspicious transactions that may relate to terrorist activity.

Bank Name Logo Employee Compliance Orientation Revised

It requires banks to produce 5 types of reports to FinCEN and the Treasury Department.

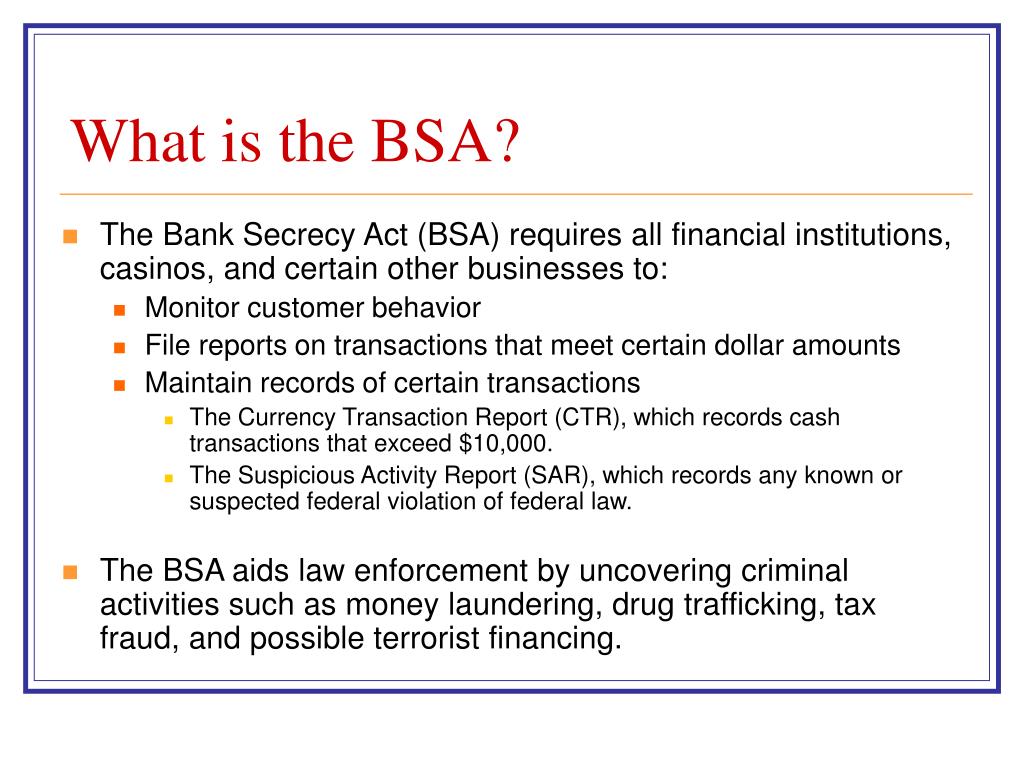

Bank secrecy act ctr requirements. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report CTR which. Law requiring financial institutions in the United States to assist US. The purpose of the hotline is to facilitate the immediate transmittal of this information to law enforcement.

The Bank Secrecy Act BSA is US. Regulations implementing Title II of the Bank Secrecy Act appear at 31 CFR 103. Nearly 50 years ago CTRs came into existence under the Bank Secrecy Act BSA which established program recordkeeping and reporting requirements for FIs.

The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. MSBs must file a Currency Transaction Report CTR within 15 days whenever a transaction or series of transactions in currency. BSA Requirements for Lenders.

Multiple cash transactions are considered to be one. Legal Reference for Bank Secrecy Act Forms and Filing Requirements The Bank Secrecy Act BSA enacted in 1970 authorizes the Secretary of the Treasury to issue regulations requiring that financial institutions keep records and file reports on certain financial transactions. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds.

Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. Currency Transaction Reports CTR.

The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. 1 Involves more than 10000 in either cash-in or cash-out and 1 Is conducted by or on behalf of the same person and 1 Is conducted on the same business day. Since then the CTR form has been modernized several times to streamline and simplify submission requirements and an electronic filing requirement for all CTRs was instituted.

For this reason the Financial Crimes Enforcement Network FinCEN has established guidelines for determining who fits in each phase. 8009492732 Monday thru Friday 800 am. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports of cash transactions exceeding 10000 daily aggregate amount and to report suspicious activity that might signify money laundering tax evasion or other criminal activities.

CTR Filing Requirements Customer and Transaction Information All CTRs required by 31 CFR 10322 of the Financial Recordkeeping and Reporting of Currency and Foreign DSC Risk Management Manual of Examination Policies 81-1 Bank Secrecy Act 12-04 Federal Deposit Insurance Corporation. Under Bank Secrecy Act BSA regulations there are essentially two groups of entities that can be exempt from filing a currency transaction report CTR under Phase I and Phase II. The law requires financial institutions to provide.

9 Part 353 of the FDIC Rules and Regulations parallels 31 CFR 10318 related to suspicious activity reporting requirements. This webinar will help to understand the fundamental requirements of the BSAAML statutes and. This contains any cash transaction that exceeds 10000 in one business day.

The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Government agencies in detecting and preventing money laundering. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank.

31 USC 5318a2 General Powers of the Secretary allows the Secretary of the Treasury to require a class of domestic financial institutions or nonfinancial trades or businesses to maintain appropriate procedures to ensure compliance with the Bank Secrecy Act and its regulations or to guard against money laundering. 4 The regulations in the Bank Secrecy Act also provide banks with the ability to exempt certain customers from currency transaction reporting. The Fundamentals - CIP CDD EDD CTR and Current Issues.

Congress introduced the Bank Secrecy Act. It can include multiple. - 500 pm Eastern.

In 1970 the US. A currency transaction report CTR is a bank form used in the United States to help prevent money laundering. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs.

This form must be filled out by a bank. The BSA is an amendment to the Federal Deposit Insurance Act. For financial institutions with questions relating to Bank Secrecy Act and USA PATRIOT Act requirements and forms call.

The Bank Secrecy Act and its implementing regulations require financial institutions to file a CTR on any transaction in currency of more than 10000.

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 192736

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 192736

10 Fast Facts About The Bank Secrecy Act

The Bank Secrecy Act Five Decades Of Fighting Financial Crime

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download

Bank Secrecy Act Bsa Office Of Foreign Assets Control Ofac Ppt Video Online Download

Bank Secrecy Act Understanding Its Reporting Requirements

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Complianceonline Bank Secrecy Act Quiz Proprofs Quiz

Bank Secrecy Act Anti Money Laundering Examination Manual Ffiec

The world of laws can seem to be a bowl of alphabet soup at occasions. US cash laundering rules are not any exception. We have compiled a listing of the top ten money laundering acronyms and their definitions. TMP Danger is consulting agency centered on defending monetary companies by lowering threat, fraud and losses. We've got huge bank expertise in operational and regulatory risk. We now have a strong background in program administration, regulatory and operational threat in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus money laundering brings many hostile penalties to the organization as a result of dangers it presents. It will increase the chance of major risks and the opportunity price of the financial institution and ultimately causes the financial institution to face losses.

Comments

Post a Comment